The Baylor Way

Baylor University’s Office of Investments has made national news in recent months after the Wall Street Journal announced the University’s endowment has an average annual gain that outpaced all but one of the Ivy League universities.

Four years ago, Baylor’s endowment ranked No. 52 in the five-year rankings of the National Association of College and University Business Officers (NACUBO). Now, the University ranks second behind only Brown University.

“We have been paying attention to the NACUBO rankings,” Renee Hanna, the managing director of Investments, said. “We are all super competitive, and it feels great. But it has never been the goal to beat the Ivies.”

The goal of the Investments team has always been to grow the endowment to support the needs of the University better, Hanna said. The endowment serves as a piece of Baylor’s operating budget, but most of it provides scholarships to students and affords professorships.

The healthier the endowment, the healthier the university, Hanna said. Asset allocation models vary across universities and many have been successful, but the Baylor Investments team knows which technique works best for them.

“Let’s do it the Baylor way.”

Hanna joined the Investments team in May 2008. In her eyes, there was a lot of great talent at the University. Still, they also experienced quite a bit of turnover in the chief investment officer (CIO) position over the next few years. Finally, in 2010, Brian Webb was hired for the role. Webb would later hire David Morehead, who was named Baylor’s CIO in 2021.

The past decade has seen tremendous growth in operations for the team, Hanna said. She attributes it to their stability under Webb and Morehead’s leadership.

“The continuity and the steady hand of leadership has been really important,” she said. “There is a lot of institutional knowledge that gets to stay with the University. Having this framework in place and individuals who have bought in allows us to be nimble and focused.”

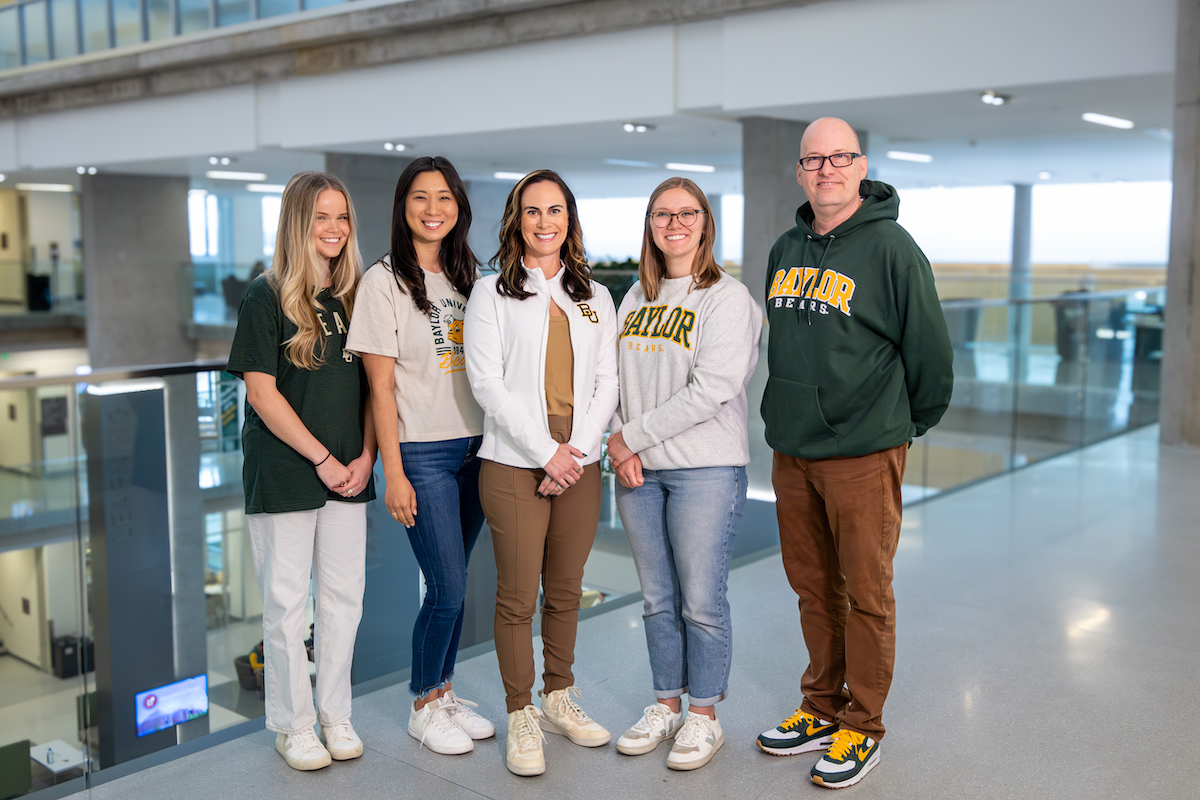

What helped Hanna buy in was her time as a student at Baylor. Hanna graduated from Baylor’s Hankamer School of Business (HSB) with a BBA in Finance in 2005. In fact, four of the five members of the Investment team are Hankamer graduates.

“I think that is what binds us together,” Hanna said. “It keeps us aligned with the mission. And when you bring in someone who is a Business School undergrad, they have already bought into that mission.”

They have also bought into Waco, Hanna said. That is essential, as Baylor’s home is a very different market than Dallas, Austin or New York City.

Jin Dingmore, the director of investments, joined the team in 2015 after earning her BBA from Baylor. She had participated in the Baylor Business Fellows program, where she majored in Economics and Mathematics. It was a helpful foundation as she built her quantitative skill sets.

“I didn’t have a finance-specific background,” Dingmore said. “But my economics and business core classes gave me a great foundation on how to think about the building blocks of the industry.”

What made her education memorable for Dingmore was the faith-oriented approach, she said. She recalls reading CS Lewis and Wendell Berry in her business courses.

“You’re not going to get that at every Business School,” she said. “I feel like that is one aspect that sets Baylor apart.”

Maggie Woodhill, the senior investment analyst, also graduated from the Business Fellows program. She earned her degree in 2020 and joined the Office of Investments later that year. The Business Fellows program allowed Woodhill to explore a variety of majors and minors across the Business School and exposed her to different methods of thinking.

“The Business School and Business Fellows fostered my curiosity,” she said. “It taught me a wide array of perspectives and viewing the world. That has been one of the biggest things that has impacted my career.”

Both Dingmore and Woodhill agreed their love for Baylor has also helped them in their careers.

“Working for your alma mater is incredibly meaningful,” Dingmore said. “We are all familiar with the mission of Baylor and have a uniform set of shared values.”

For Woodhill, it is the shared focus that gets her excited.

“We love that the work we do serves a mission and a mission-minded purpose,” she said.

Woodhill understood the Office of Investments' mission before graduating. While attending Baylor, Woodhill also interned with the Investments team. The internship program allowed her to further her educational experience while assisting the Investments team in operations.

Although the internship program has been around for a long time, it was revamped after the COVID-19 pandemic forced the team to reevaluate its structure.

It was helpful that Woodhill participated in the program. She knew what areas were vital and which needed to grow. Together, Dingmore and Woodhill revitalized the program to what it is today.

The new structure is more intentional than the previous model, Dingmore said. They target students who will be juniors at the time of their internship and look for students who are curious in nature.

“At the end of the day, this job requires a lot of unique skills that are not necessarily reflected in your GPA,” Woodhill said. “We want to know how curious you are about the world. What interests you?”

The Investment team approaches the markets as if it were a puzzle, Woodhill said. They are constantly trying to figure out the puzzle as a group to approach the market in the best way possible, so intellectually curious students are ideal for this program, she said.

Dingmore knows great, intellectually-curious talent exists at the Hankamer School of Business.

“We want to be involved with the Business School to the extent that we can be helpful,” she said. “I think this is one of those ways that it can be a mutual value add.”

The interns spend their time in the office working hands-on with the rest of the Investment team. And it’s not just work-related conversations. Dingmore and the team also invest time into the students’ future.

“We talk to them about what major they will choose, how to choose an industry within their field of study, the many different paths they can take through their career, things like that,” she said. “But they are also exposed to every single meeting, every single workflow and every part of our office. We want it to be a learning experience separate from the classroom and yet complementary, and you get to see how the skills you are learning in the classroom are applied in industry.”

The Investments team’s involvement at the Business School goes beyond the internship program. Both Morehead and Hanna teach a year-long Finance course at HSB, Small-Cap Investing, where students gain hands-on experience researching, analyzing and managing a portfolio of small-cap stocks.

In this course, the team met their newest member, Kailey Ransom. A 2023 graduate of the Business School, Ransom serves as an investment analyst for the office. She assists on the sourcing front, learning about new managers and potential new investments.

As a Business Fellows student, Ransom gained various experiences that helped her in her day-to-day tasks, although those change daily in her role. Her Marketing courses required her to deliver numerous presentations and interact with small businesses in Waco.

“Those experiences gave me the confidence to speak to some of the people I interact with regularly in my job,” she said. “I credit my confidence and professional skills to the Business School.”

Ransom echoed her team’s sentiments about working for their alma mater, especially considering she benefitted from the endowment as a student.

“I had a scholarship when I was a student, and I am sure there were a lot of things that the endowment provided or helped fund that I benefited from,” Ransom said. “It is cool to be on the backside of that now and ideally help grow scholarships and professor fellowships.”

The team’s success in growing the endowment did not come overnight. It required a solid foundation laid more than a decade ago and a commitment to building a quality culture in the office. That is reflected in the team’s core values: integrity, excellence, gratitude, humility, accountability and fun.

“They all go hand in hand,” Dingmore said. “We don’t want to compromise integrity to get excellent results because that’s not right or sustainable, but you have to have high integrity to achieve high results.”

Baylor’s Office of Investments has achieved high results recently, but they don’t plan to stop there. It’s not the success or comparisons to the Ivies motivating the team—it’s the ability to give back to the University that helped them reach new heights.

“The performance speaks for itself,” Hanna said. “But I’m most proud to have Baylor and the Hankamer School of Business recognized. We are generating best-in-class returns, and we are doing it with Baylor grads.”

They are doing it with Baylor grads and doing it the Baylor way.